In today’s fast-moving world, everyone wants quick solutions for their financial needs. Digital lending and payment platforms are becoming a big part of our daily lives. Among them, KreditBee has emerged as a trusted option, offering both instant personal loans and UPI payment services to young professionals.

This article will walk you through what editBee Kris, its features, how to apply for a loan, interest rates, UPI benefits, and safety tips.

What is KreditBee?

KreditBee is a digital lending platform designed mainly for young professionals and salaried individuals. It not only provides quick personal loans but also offers UPI payment solutions. The best part is that you can borrow from ₹1,000 to ₹3 lakhs instantly through a fully digital process.

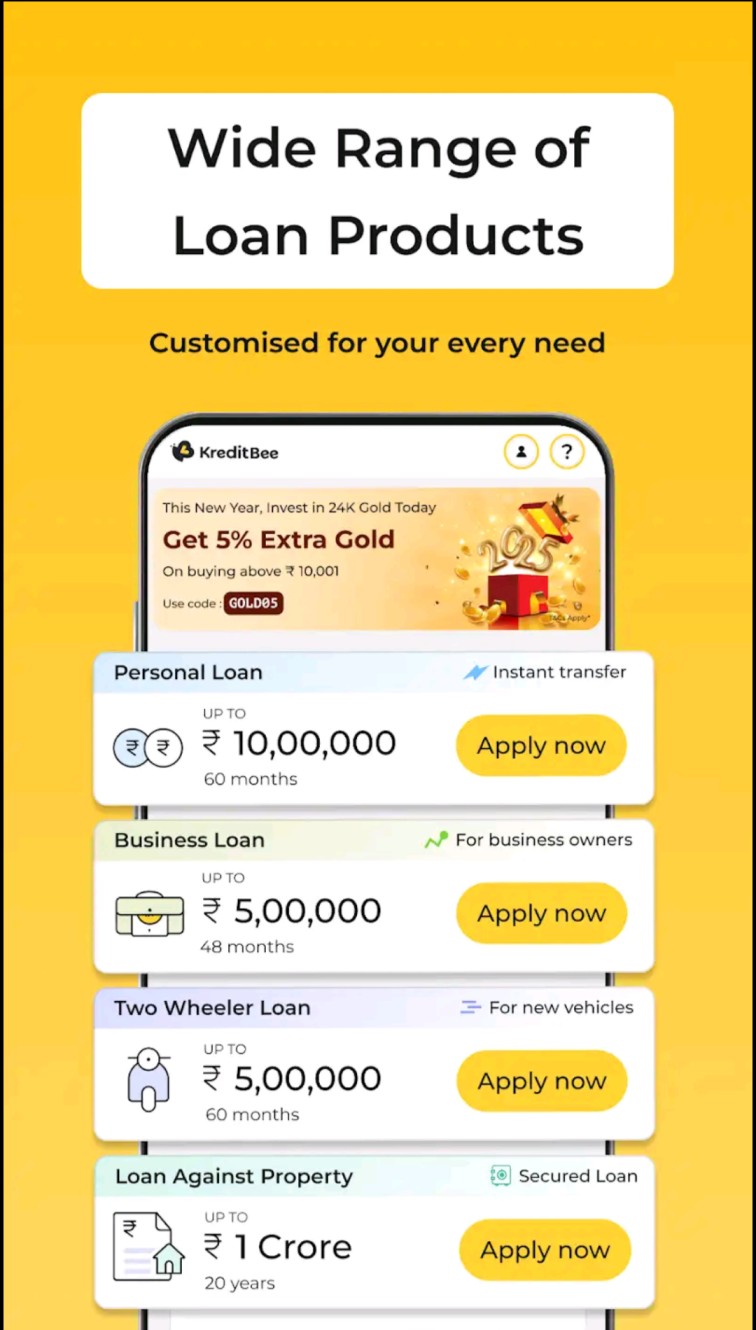

Key Services Offered by KreditBee

Personal Loans

Loan amount: ₹1,000 to ₹3,00,000

Flexible repayment tenure: 2 to 15 months

Entirely online and paperless process

KreditBee UPI

Instant money transfers from any bank account

QR code–based payments

Supports mobile recharge, bill payments, and online shopping

Credit Health & Management

On-time EMI payments improve your CIBIL score

Transaction history and repayment tracking inside the app

Features of KreditBee Personal Loans

Instant Approval – Loan approval in less than 10 minutes

100% Digital KYC – Using Aadhaar, PAN, and bank details

24/7 Availability – Apply anytime, anywhere

Flexible Tenure – Choose repayment period as per your income

Interest Rates and Charges

Interest rate: 1.02% to 2.49% per month (APR: 12% to 29%)

Processing fees: 2% to 8% (depending on loan amount)

Late payment penalty charges applicable

This means if you repay on time, KreditBee can be a cost-effective solution.

How to Apply for a Loan on KreditBee (Step-by-Step Guide)

Download the KreditBee App from Google Play Store.

Register using your mobile number.

Complete KYC using Aadhaar and PAN.

Link your bank account.

Select loan amount and tenure.

Once approved, the money is instantly credited to your bank account.

Credible UPI – Key Highlights

Fast transactions – Send and receive money instantly

QR code payments – Useful for shops and online purchases

No extra charges – Just like regular UPI services

Safe & Secure – Follows RBI and NPCI guidelines

Advantages of Using KreditBee

Quick loan access for young professionals

Hassle-free documentation

Instant money transfer to bank accounts

Easy day-to-day payments with UPI

Improve credit score with timely EMI payments

Things to Keep in Mind

Always pay your EMIs on time to maintain a good credit score.

Borrow only as much as you really need.

Never share your OTP or UPI PIN with anyone.

Download the app only from the official Play Store or website.

Why Choose KreditBee

In today’s fast-paced lifestyle, when money is needed instantly, KreditBee provides a reliable and safe solution. With personal loans and UPI combined, the app not only helps in emergencies but also makes daily transactions much easier.

Conclusion

KreditBee Personal Loan and UPI services are a perfect fit for young professionals looking for quick and reliable financial support. With its digital process, easy documentation, and instant disbursal, KreditBee saves both time and effort. However, remember to borrow responsibly and always repay on time to keep your financial health strong.